Tax Planning

Tax Planning Process

Retirement Portfolio Partners’ tax planning focus is to minimize taxes in the present and during retirement. We accomplish this by evaluating:

Where to put additional savings to maximize your finances (ex. HSA vs. Roth IRA vs. 401k vs. 529 plan vs. Trust account)

Roth Analysis (Roth IRA contributions, Roth conversions, etc.)

Cash-flow planning to better manage and minimize taxes (ex. Income, Social Security, pensions, required minimum distributions, tax-efficient retirement income distribution etc.)

Investment strategies (ex. Long-term vs. short-term capital gains, tax-loss harvesting, asset location, etc.)

Annual gifting strategies (ex. College planning, lessening estate planning burden, etc.)

Charitable Giving Strategies (ex. Donor-advised funds, qualified charitable contributions, etc.)

Sample Tax Planning Report

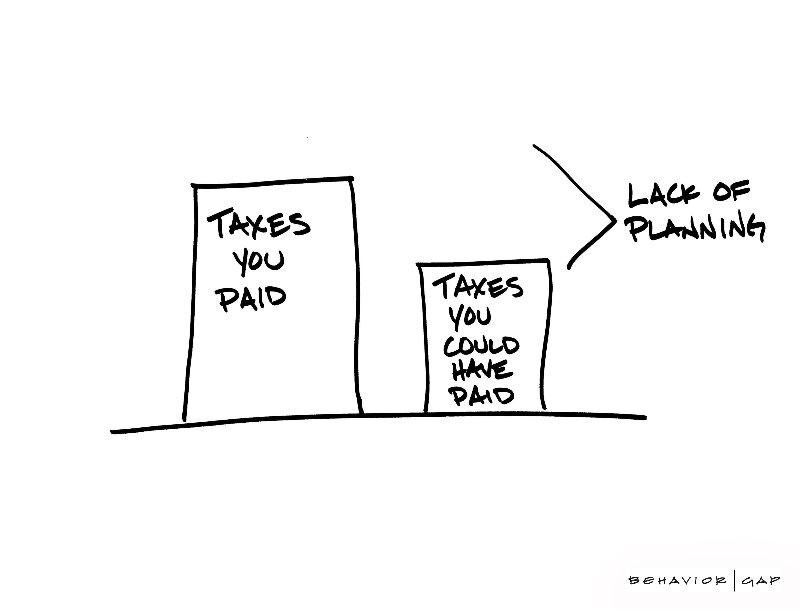

Tax laws change all the time and have significant implications. You might be paying more taxes if you’re not aware of these changes. How you earn, save, spend, and invest your money impacts your tax return. That’s why advanced planning is best to evaluate cash flows and minimize taxes.

We stay up-to-date with tax laws and can work directly with your CPA to help make your financial life run more smoothly.