Retirement Income

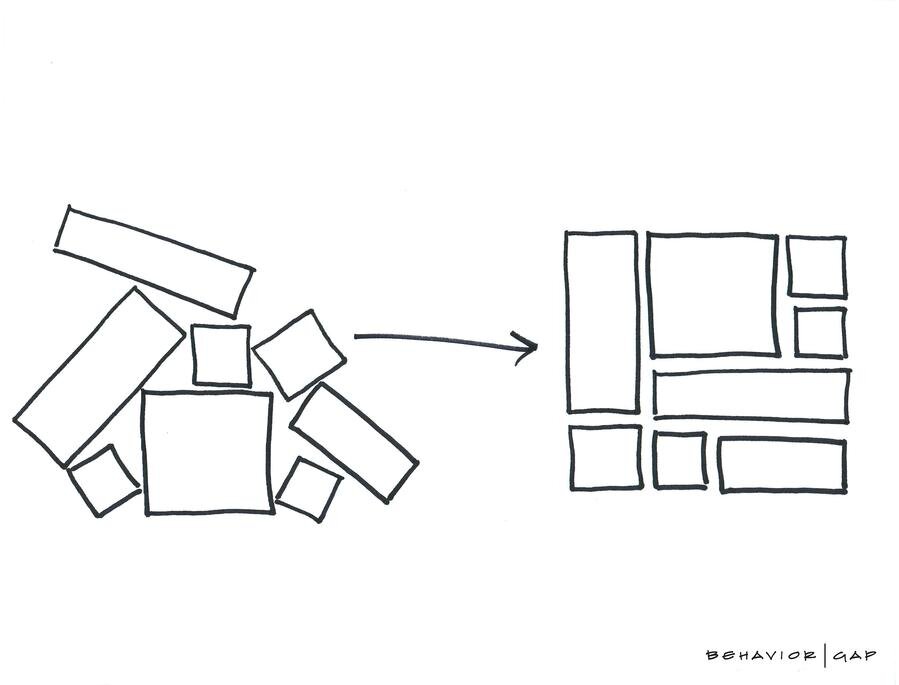

When you no longer have a paycheck, cash flow can get complicated. Retirement income functions very differently from income during your working years. When employed you probably had a single empoyer and a single income source.

As a retiree, you likely receive income from multiple sources:

Social Security

Pensions

Rental Income

Required Minimum Distributions(RMDs)

And more.

While working, you receive a check regularly—such as every two weeks. As a retired person, you might receive income monthly, quarterly, annually, and even sporadically. Add the fact that part of your retirement income likely will come from investments (savings)—which you must protect to make them last—and it can all seem confusing.

And then, of course, there are the tax implications, such as the fact that distributions from a Roth IRA are tax-free, while those from a traditional IRA are taxed at your current income tax bracket. Finally, when you reach the age of 72, you'll likely also have required minimum distributions (RMDs) to manage.

We help turn your nest egg into a reliable income stream.

Our approach is backed by decades of academic research and helps:

Keep your taxes low

Reduce costs

Maximize your investment return

Lower portfolio risk

Preserve your savings